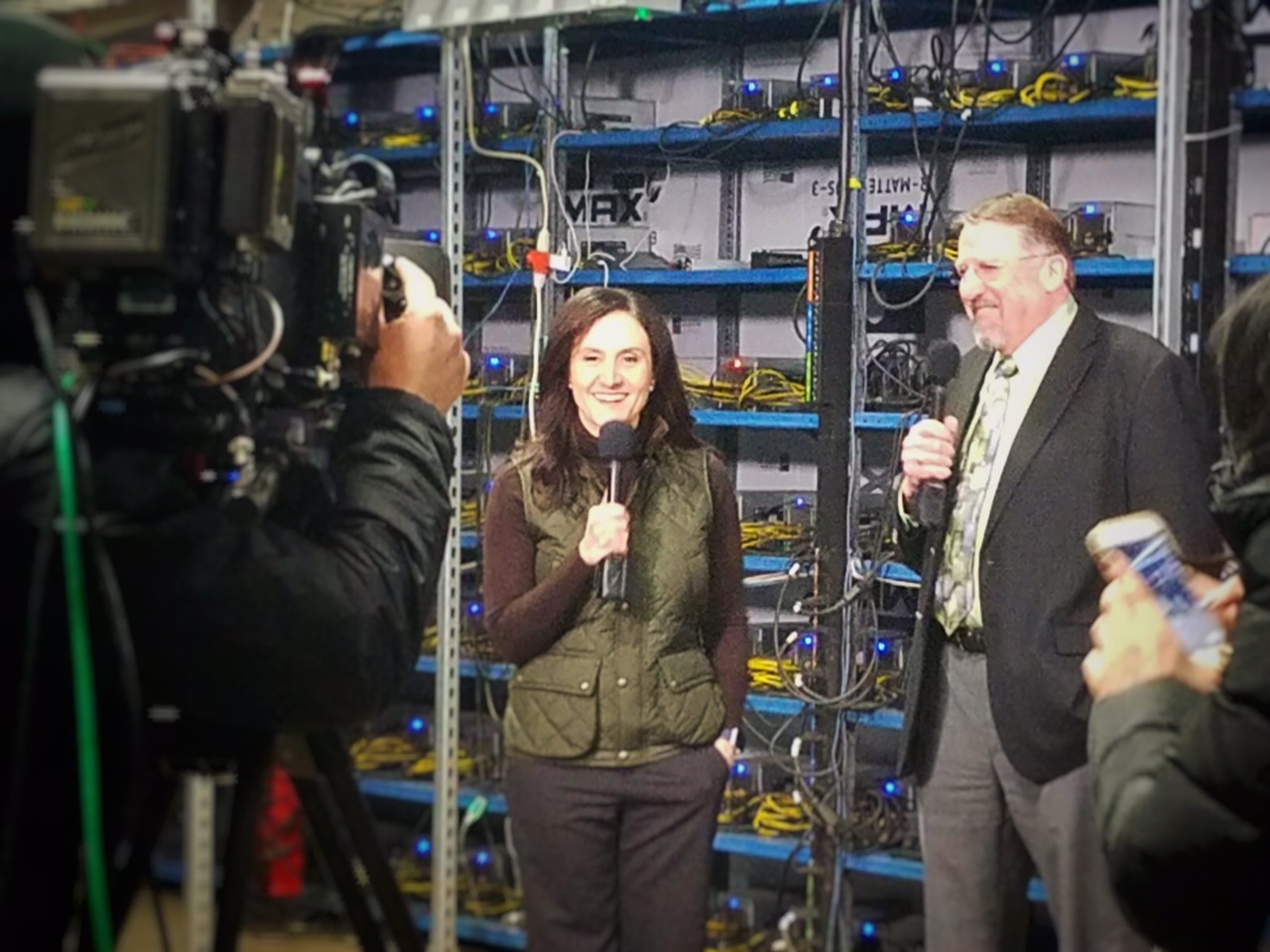

Bitcoin.com's Cindy Wang picks up on the story of Wenatchee's bitcoin mining activity. From the article:

"'We’ve come from just a few people out there who have been knocking on the door to all of a sudden to people who are banging on the door pretty loudly.'

Bitcoin mining is known to be energy-consuming. But miners here appear not to have this problem. Power is extremely cheap for the town— only 2 to 3 cents per kilowatt hour."